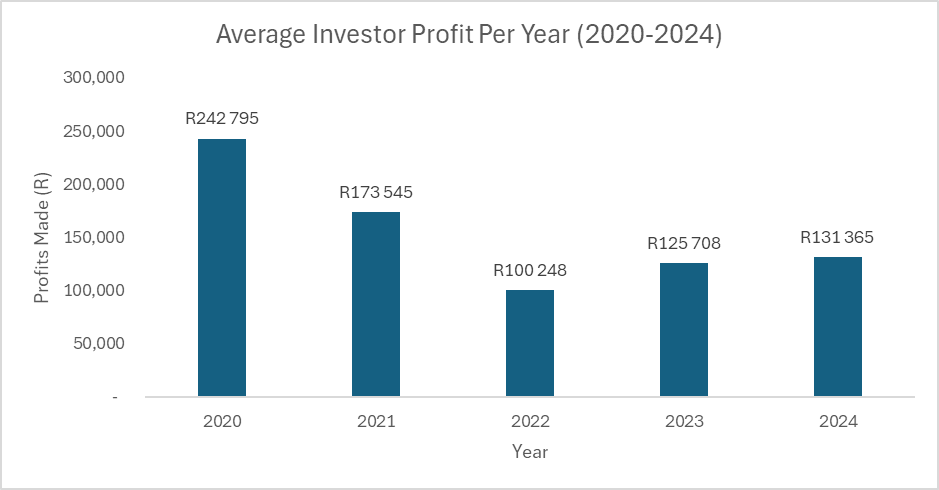

In the world of arbitrage investment, few names carry as much weight as Shiftly does today in South Africa. But the journey to this point has been anything but smooth. To date, Shiftly has processed 26 billion rand in volume and returned over 320 million rand in profits to investors, boasting an annual average profit of 142,500 rand per investor.

Today, Shiftly proudly employs 14 full-time staff, including in-house developers, client relationship managers, and FSCA-registered representatives. Shiftly holds multiple licenses—serving as a fully licensed Financial Services Provider (FSP no: 51806), an accountable institution with the Financial Intelligence Centre (FIC IDs: FSP 55458 & CASP 69395), and a registered Treasury Outsourcing Company (TOC no: 3119) with the South African Reserve Bank—all underscoring its commitment to investor protection and industry best practices. As part of the Crypto Asset Association of South Africa (CAASA), Shiftly continues to support the growth of the industry and uphold the highest standards of transparency and compliance.

The Journey Begins:

In 2019, in the quaint town of Somerset West, South Africa, two cousins with a vision for financial innovation founded Shiftly. Since 2013, they had been captivated by the potential and societal benefits of cryptocurrencies, diving into cryptocurrency arbitrage. Like many startups without seed capital, they began operations from a room in their home, with the first employees being close friends and family.

Understanding Arbitrage:

An arbitrage transaction involves two essential components:

The Foreign Currency Conversion Leg: Converting South African Rands into currencies like Dollars or Pounds to purchase the underlying asset with.

The Arbitrage Leg: The critical phase where the asset is bought and sold to exploit price differences between locations for profit.

Essentially, arbitrage means buying low in one place and selling high in another, exploiting temporary price differences.

Initially, Shiftly focused solely on the arbitrage leg, entrusting the foreign currency conversion to external intermediaries. However, as profit margins tightened, maximising returns required innovation.

Navigating Regulatory Landscapes:

To maximise arbitrage investment returns, utilising the R10 million annual Foreign Investment Allowance (FIA) is advised, which requires an application to the South African Revenue Service (SARS). Early in 2021, changes to SARS E-filing system significantly delayed access to this allowance, impacting investor returns. Shiftly played a pivotal role in discussions with SARS, leading to a beneficial solution being built into E-filing and addressing the needs of all parties involved.

Amidst regulatory challenges, Shiftly also concentrated on enhancing the user experience by developing and launching a brand-new client portal. Designed to be intuitive, secure, and efficient, this portal reflects Shiftly’s commitment to continuous improvement and top-tier investor service.

Adapting to Global Shifts:

In March 2023, the global regulatory crackdown on cryptocurrency companies, notably Circle’s inability to accept US Dollar deposits in the USA, forced Shiftly to pivot. Under immense pressure, the team worked non-stop to reestablish their services with new providers and banking partners. In response, the founders made the strategic decision to vertically integrate by establishing their own foreign exchange intermediary, aiming to reduce fees for investors. This bold move led to the launch of the Premium Service, the first of its kind in the arbitrage investment industry, offering investors a comprehensive, one-stop shop to capitalize on arbitrage investment opportunities.

“This was the most challenging three months in Shiftly’s history,” Carel de Villiers, co-founder and CEO, reflected. “We had to completely reinvent our business model on the fly, with the industry landscape changing around us and no clear guidance on regulations for the industry”.

Technical Overhaul for Future Growth:

Building on the success of the client portal, in 2024, Shiftly undertook its most ambitious technical project yet by developing and launching an entirely new backend system. This overhaul was aimed at boosting scalability, security, and performance to meet growing client demands and increasing transaction volumes.

A Commitment to Compliance and Excellence:

From the outset, Shiftly adopted stringent compliance policies, even before the industry became regulated, showcasing a long-term vision and commitment to best practices. Their goal was always to ensure business longevity while offering the best and lowest fee investment services.

Performance Metrics:

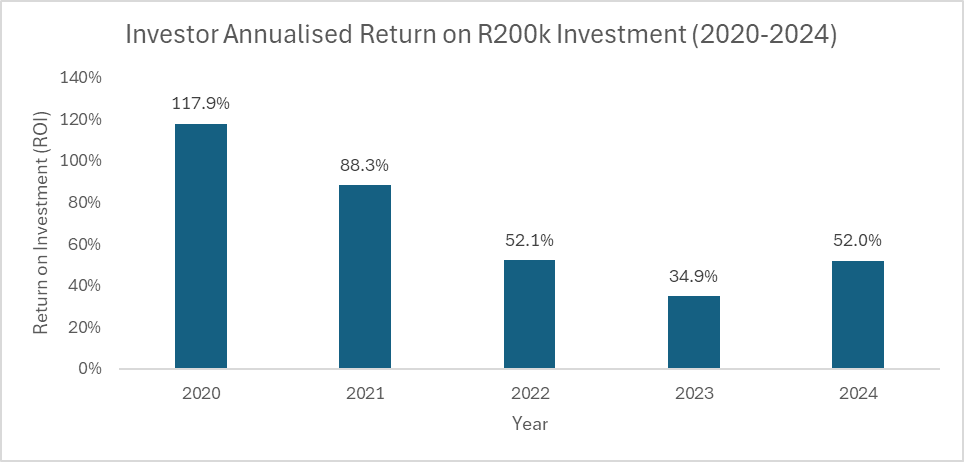

In 2024, investors enjoyed a 52% return on investment, with an average cash profit of R131,365.

How to invest with Shiftly:

Shiftly offers a fully managed arbitrage investment service for investors of any skill level. Are you ready to explore the potential of arbitrage with Shiftly? Our team is ready to answer your questions and guide you through the investment process. Please send an email to support@shiftly.co.za to get in touch.

*Past returns are no guarantee of future performance. This does not constitute financial advice.

**Shiftly FX (Pty) Ltd trading as Shiftly is a registered CAT I & II FSP no: 51806